Mortgage refinancing company starts its activity in Uzbekistan

MRC resources are refinanced against the mortgage loan portfolio, which allows providing the population with affordable and long-term mortgage loans.

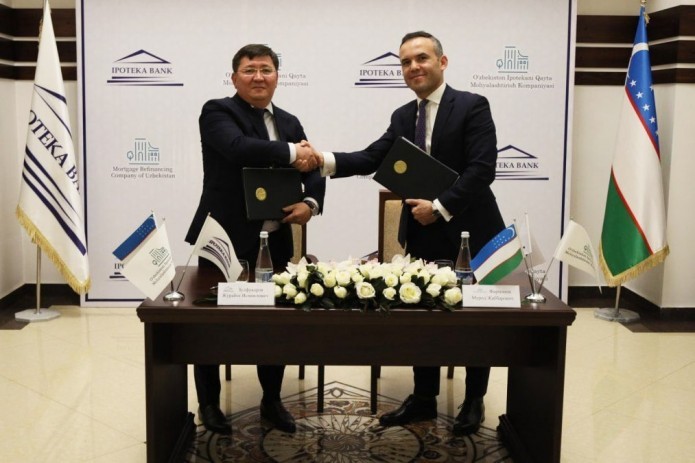

The Mortgage Refinancing Company of Uzbekistan (MRC) has started operation and signed its first contract.

The main objectives of the MRC are:

- Providing long-term financial resources to commercial banks based on market principles to meet the growing demand of the population for housing;

- Issuing mortgage-backed securities in the national currency and development of the capital market;

- Assistance in improving the mortgage lending system based on market principles;

To achieve the above goals, the first stage provides for raising funds in the amount of $150mn from the ADB and providing mortgage loans to the population through commercial banks.

MRC resources are refinanced against the mortgage loan portfolio, which allows providing the population with affordable and long-term mortgage loans.

The agreements concluded between the Ministry of Finance, ADB and MRC will provide the country's population with affordable housing on the basis of a refinancing mechanism. MRC funds will serve the development of the mortgage market based on market mechanisms, along with ensuring the stability of the long-term resource base of our commercial banks. As a result, residents of Uzbekistan will have access to cheap sources of financing for the purchase of housing from the primary and secondary markets.

.png)