Uzbek Central Bank comments on how devaluation of national currency affected deposits of individuals

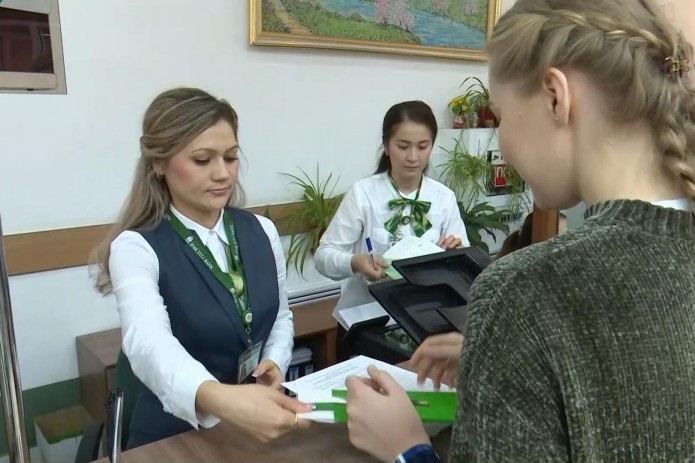

The Central Bank noted that despite the increase in short-term inflation and devaluation expectations, there was no significant outflow of deposits in the national currency or a significant change in the structure of deposits. At the same time, although the growth rate slowed down, the positive dynamics of deposits remained.

A demand for foreign currency under the influence of internal and external factors had a certain period of acceleration in July-August 2019, as a result, the devaluation of the national currency has also gathered momentum. In particular, if in January-July the exchange rate of the dollar went up by 4% (from 8336 to 8667 soums per dollar) and the monthly increase averaged 0.6%, in August there was a sharp (8.2%) increase in the exchange rate. However, by September, the dollar exchange rate had returned to its previous trend, and the monthly increase slowed to 0.5%.

According to the Central Bank, the devaluation of the national currency affected population`s propensity to save. In particular, a monthly survey conducted by the Central Bank shows that in June-September there was an increase in the proportion of respondents who prefer to store savings in foreign currency (including US dollars).

The proportion of respondents preferring to keep savings in cash in US dollars increased from 19% in May to 33% in August, and the proportion preferring to keep savings in foreign currency deposits increased from 17% in May to 24% in September. At the same time, after the exchange rate stabilized in September, the share of respondents who prefer to keep their savings in cash in US dollars fell from 33% to 29%.

The Central Bank noted that despite the increase in short-term inflation and devaluation expectations, there was no significant outflow of deposits in the national currency or a significant change in the structure of deposits. At the same time, although the growth rate slowed down, the positive dynamics of deposits remained.

.jpg)

.png)