АNOR BANK general partner of Tashkent Digital Marketing Forum 2023

АNOR BANK general partner of Tashkent Digital Marketing Forum 2023

"ANOR BANK" became the general partner of the forum, organized by the Committee for the Development of Competition and Consumer Protection. The main objectives of the forum are to develop competition in digital services, provide equal opportunities for all market participants, and increase entrepreneurship awareness of practical tools to help businesses.

One of the most critical digital sphere development areas is the banking sector. The rapid development of digital banking became possible after the signing of the relevant presidential decree, which was the impetus for developing digital banks in Uzbekistan. ANORBANK became the first domestic digital bank in Uzbekistan.

For two years, "ANOR BANK" created a solid customer base of companies, firms, and individuals. At this time, the number of attracted assets reached 3.5 trillion soums, and the total loan portfolio of 2.1 trillion soums, the number of installment card transactions was 55 thousand for the amount of 250 billion soums.

The number of clients of the Bank makes up 6 500 legal entities, whose deposits grew to 2.8 trillion soums. And the number of clients of individuals reaches up to 1 million. The total growth in the volume of deposits made 248%, and the number of depositors of individuals rose by 113%.

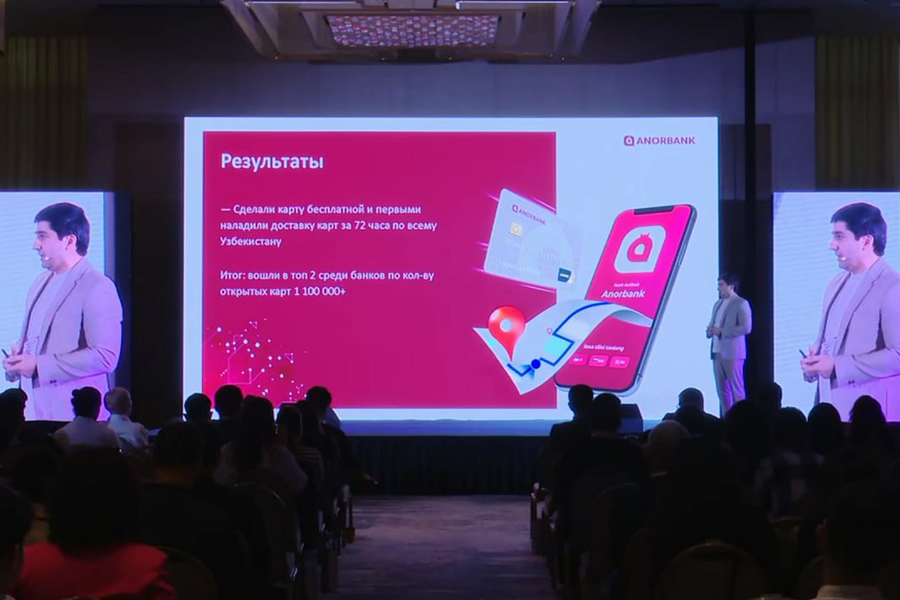

Only for the past year, 2022, the figure for issuing plastic cards was more than 1 million pieces, and the number of downloads of applications ANORBANK in the Play Market was more than 5 million. In 2022 there were more than 16 million transactions in the application ANORBANK.

ANORBANK was one of the first in the country to introduce remote identification, which allows becoming a bank client to get an online card or loan.

As noted by the deputy chairman of the board of "ANOR BANK" - Elior Najimitdinov:

"ANORBANK was one of the first to implement the receipt of an online microloan, thanks to which it became unnecessary to visit the bank, be away from work, and lose extra time waiting for approval. The number of applications for all types of online micro-loans was about 2 million.

Having studied the consumer bank released a unique deposit on the market at that time, attractive from the client's standpoint: rate, term, possible to withdraw and increase at any time".

On the second day of the Tashkent Digital Marketing Forum, several dozen categories of the most successful brands, agencies, and bloggers were awarded. ANORBANK deservedly won the nomination for "The fastest growing digital bank in 2022". The award was received by the Chairman of the Board of ANOR BANK JSC, Sherzod Akramov.

For Reference

ANOR BANK" JSC - the first domestic, commercial digital bank, which received a license for banking activity on August 22, 2020. In September, it began full-scale work and started providing online services.

"ANOR BANK" provides a full range of banking services for individuals and businesses without visiting the bank. All services can be received on the website, mobile application, or by the round-the-clock contact center. The innovative concept of digital banking reflects the demands of the present. Society has become more mobile, everyone prefers to use digital technology and receive most services remotely and around the clock from anywhere in the world.

"ANOR BANK" makes much effort to process any request as quickly as possible while maintaining an individual approach to each client and guaranteeing data processing security.

In 2022 "ANORBANK" was awarded the highest award of the National Bank Award for implementing the project on the implementation of speech technologies using the omnichannel dialogue platform from BSS Uzbekistan.

.jpg)

.png)