Ipoteka-Bank becomes first Uzbek bank to issue UZS-denominated Eurobonds

Uzbek Joint-Stock Commercial Mortgage Bank Ipoteka-Bank (Ipoteka) became the first among the corporate issuers of Uzbekistan to successfully issue and place bonds in the national currency on the international capital market.

Uzbek Joint-Stock Commercial Mortgage Bank Ipoteka-Bank (Ipoteka) became the first among the corporate issuers of Uzbekistan to successfully issue and place bonds in the national currency on the international capital market.

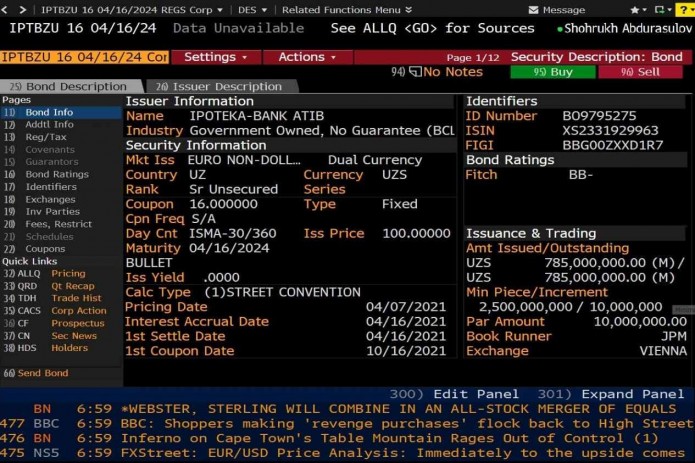

The 3-year eurobonds of Ipoteka in the amount of UZS 785bn (equivalent to up to $75mn) were successfully placed on the International Vienna Stock Exchange on April 16, 2021 with a coupon rate of 16% per annum (with an effective rate of 16.5% per annum).

The placement was carried out in accordance with the recommendations of the underwriter bank of the transaction J. P. Morgan Chase and the Finance Ministry of Uzbekistan.

“This transaction is significant, as it is the first in our history placement of UZS-denominated international bonds. This issue should be an incentive for other potential issuers of the country planning to place securities on international capital markets, serve as an additional source of raising long-term resources in the national currency from abroad, as well as reduce currency risks and the level of dollarization”, Ipoteka said in a statement.

In April this year, Fitch rated the now completed issue at BB-(EXP)'/'RR4.

The Uzbek bank made its first $300mn worth eurobond issue in November 2020. A listing was made on the London Stock Exchange.

.png)